ABOUT VNDAF

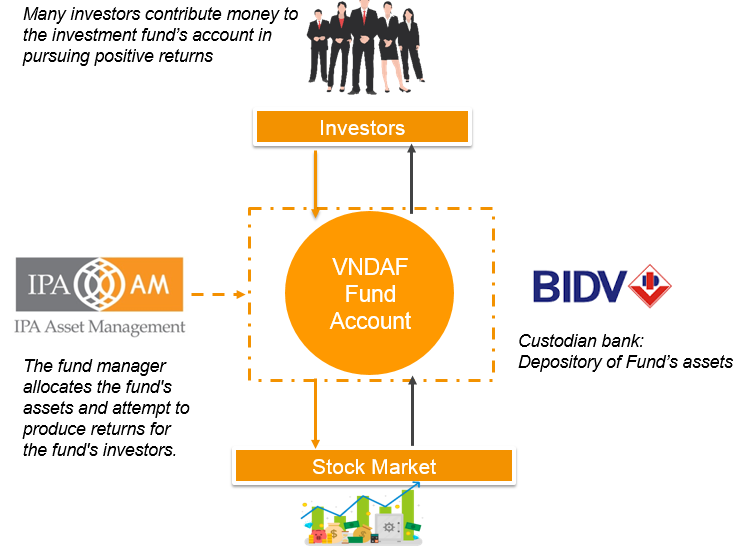

VNDAF is an open-ended fund investing in stock market, following a predetermined strategy. It is a product of long-term asset accumulation, taking advantages of the Vietnamese stock market’s growth. The Fund’s assets are independently managed and supervised at BIDV Depository Bank. Fund certificate transactions are conducted via Vietnam Securities Depository (VSD), under the supervision of State Securities Commission (SSC).

Fund Management Company

IPA Asset Management (100% owned by VNDIRECT)

Custodial bank: BIDV

Distribution agent: VNDIRECT

FINCORP

IPAAM

Trading frequency: From Monday to Friday

Minimum / maximum investment amount: 100,000 VND / unlimited

INVESTMENT STRATEGY

The investment strategy of VNDAF is to proactively manage risks in order to achieve remarkable profits compared to VN30 and VNIndex.

- Investing in the portfolio of stocks which has largest capitalization in the market and is favored by foreign investors.

- Having basic and strict criteria filter on enterprises’ business capacity and corporate governance capacity to eliminate stocks lacking long-term sustainable development foundation or having high cyclical and risk factors, to minimize particular risks of Vietnam’s stock market.

- Identifying market risks, using derivative tools to prevent risks, promoting capital preservation discipline.

INVESTMENT PORTFOLIO

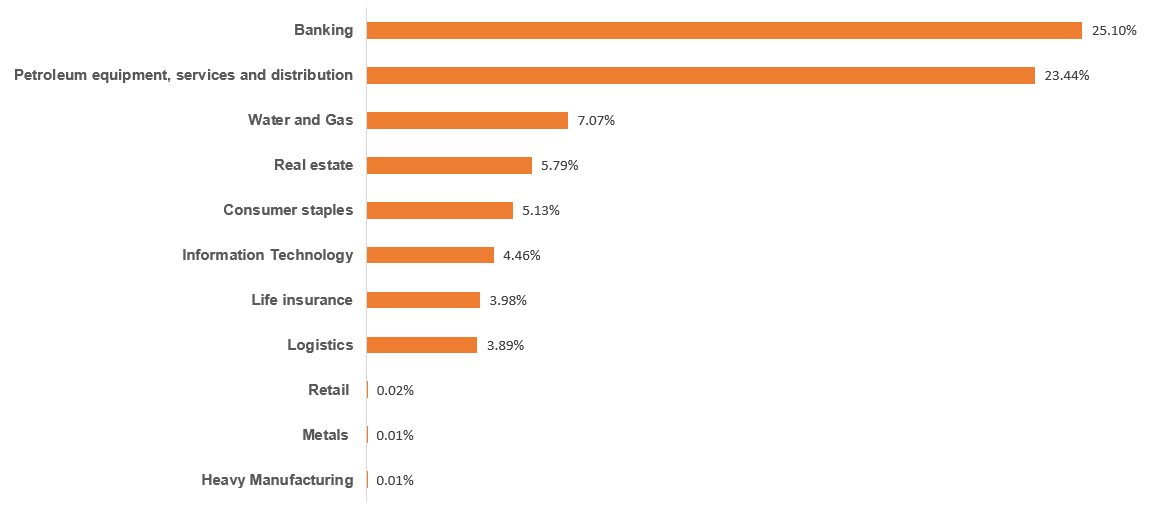

Asset allocation by industry

At 31/01/2026

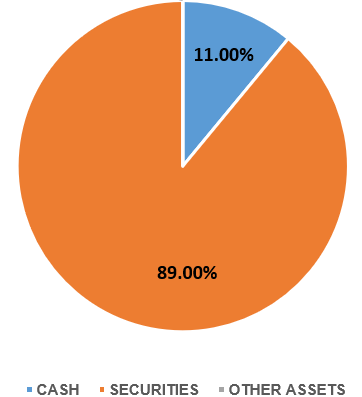

Asset allocation by asset class

At 31/01/2026

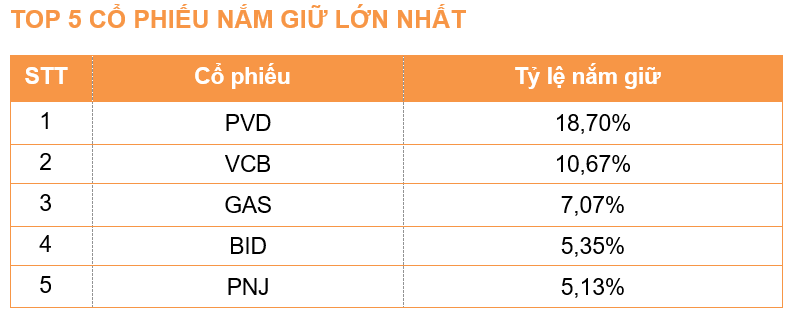

Top holdings

At 31/01/2026

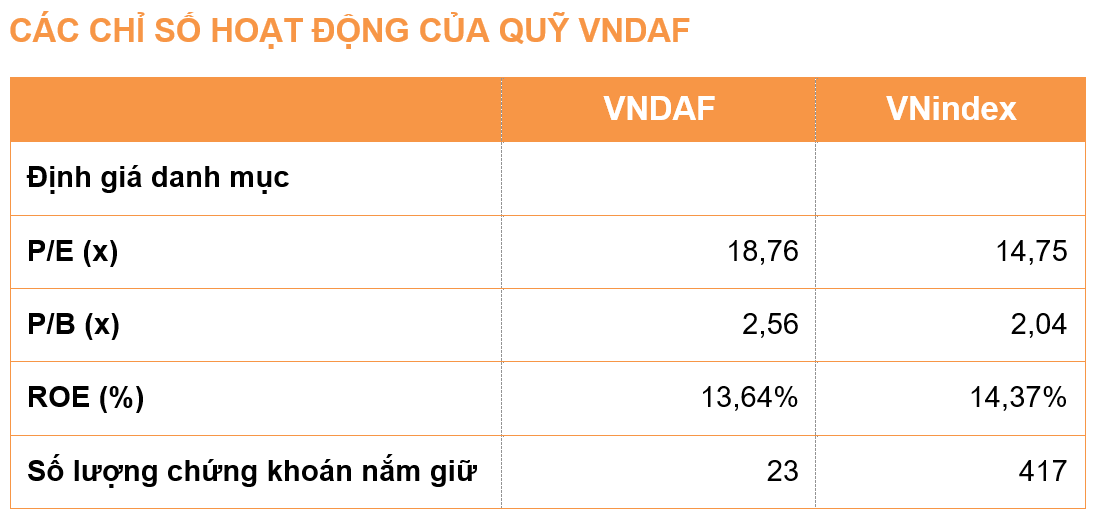

Performance indicators

At 31/01/2026

FAQs

How long does an open-ended fund operate?

Open-ended fund has unlimited term

What does the fund invest in? Is the fund investment risky?

VNDAF invests in the stock market, more specifically include:

- Mostly Vietnamese listed stocks

All equity investment activities have potential risks. However, with Open-ended Funds, investment activities must comply with the investment procedures, portfolio diversification requirements and strict risk control. The Fund is also supervised by the Board of Representatives, Supervisory Bank and the State Securities Commission. The fund is managed by experienced professionals who adhere to investment discipline and have a risk management strategy.

Where does the fund's profits come from?

The profit of the VNDAF mainly comes from investing in listed securities on the Vietnamese stock market, including:

- Capital gain from the increase in the price of the shares that the fund is holding;

- Dividends of shares held by the fund

Is the return on an open-ended fund always higher than the saving interest rates?

Open-ended funds aim to achieve long-term returns higher than interest rates of bank deposits. Bank deposits have guaranteed interest rates so profits are limited. Open-ended funds profit from capital growth and income from investments, so there is no limitation of the fund profits. However, in the short term, the fund may have higher or lower returns than bank deposits due to market fluctuations.

Do open-ended funds guarantee profits? What should I do if the fund is at a loss?

Open-ended funds cannot guarantee a return to investors (as stated by the Securities law). The NAV (Net asset value) price of fund certificates may fall below the value purchased by investors due to market fluctuations. However, since investing in funds is an investment to get high returns over the long term, the secret to accepting market volatility is to focus on long-term results rather than day-to-day changes.

Liquidity of open-ended funds compared to other investment channels?

Open-ended fund has HIGHER liquidity than other investment channels. Fund investors can withdraw part or all of the investment easily and quickly by selling fund certificates to IPAAM at any time. IPAAM is responsible for buying back all fund certificates at the price equal to NAV per fund certificate.

How to calculate NAV of an open-ended fund?

Fund certificate price = (Total Market Value of Fund’s Assets – Total Debt of Fund)/ Total number of Fund Certificates.

How transparence is the fund? Is there a risk of losing money?

- All fund assets are supervised in the fund account at the Custodian Bank – BIDV, which is a State-owned bank and one of the Big 4 banks in Vietnam. The fund NAV is calculated independently and objectively by Custodian Bank BIDV.

- Report on NAV of the fund and value of fund certificates is published daily on the website of the fund management company: http://ipaam.com.vn; reported to the SSC and posted on the SSC website.

- Payment transactions to buy fund certificates of investors are deposited directly into the fund account at BIDV. When the customer sells the fund certificates, the proceed from sales of the fund certificate is transferred directly from the fund account at BIDV to the bank account that the customer has registered to receive money. Thus, there is no cash transaction from the fund’s account with VNDIRECT/IPAAM employees.

Is there a certificate of ownership of fund certificates? If there is no certificate, how to certify the customer's ownership if there is a complaint?

- The value of the fund certificate changes daily, accordingly the investment value of the client also changes frequently. So there is no “Certificate“ of investment value for the Client.

- In case of customer request, the Fund Management Company is willing to provide Fund Certificate Account Statement at the time of customer request (similar to bank account statement at a point in time).

- For fund transactions, there is complete evidence of customer transactions confirmed and provided by third parties, including investment money transferred to BIDV and matched orders confirmed by Vietnam Depository Center (VSD). Therefore, it is possible to provide sufficient evidence to customers when needed.

Does the fund pay an annual dividend? What is the dividend rate?

Open-ended funds use money to invest, so there is usually no annual dividend policy. The fund’s profits will usually be continuously reinvested with an aim to generate returns to customers. In case the customer wishes to receive the profit of the fund when the price has growth, the customer can sell a part of the fund certificates to realize the profit.

If the fund cannot find effective investment opportunities and change the dividend policy (i.e. decide to pay dividends), when the decision is made we will promptly notify the customers.

How long should I invest in an open-ended fund to get the best return?

Statistically, open-ended funds provide high returns in the long run, higher than savings interest rates and bond investment rates. Therefore, an open-ended fund can provide a higher return when you invest for the long term. Investment time depends on your own financial goals and the amount of money you intend to invest. It is recommended that the fund investment period should be 5 years or more.

Does the customer have to keep certain amount of money (or fund certificates) to maintain the fund trading account? Is it possible to sell all the fund certificates in the account?

VNDAF does not require a Minimum Balance to maintain the fund trading account. In case the Customer sells all of the fund certificates, the Customer is deemed to close the fund trading account. When the Customer wants to invest in the fund again, the distribution agent will reactivate the account for customer.

When should I start investing in open-ended funds?

Investment returns from open-ended funds come from the growth of the stock market through the power of compound interest and investment time. Therefore, you should invest in open-ended funds as soon as possible and as soon as you have determined your financial goals. Delaying investing only increases your burdens and makes it more difficult to achieve your financial goals.