VNDBF – VND Bond Fund

- VNDBF is a form of investment fund contributed by many investors into a common account deposited at BIDV.

- The fund management company will manage the general account of VNDBF to invest in a portfolio of fixed-income assets including listed bonds, deposit certificates and other fixed-rate assets to bring back attractive interest rates for investors.

- When investors want to withdraw money, they sell VNDBF fund certificates to get money and profits back. The fund management company is committed to ensuring the liquidity of VNDBF.

Transaction code: VNDBF

Official first transaction date : 16/07/2019

OUTSTANDING BENEFITS OF VNDBF

![]()

HIGH PROFIT

Interest rates up to 7.5% – 8.0% with flexible term

![]()

FLEXIBLE BUYING CAPITAL

Investment participation is only from 100.000 VND to unlimited

![]()

HIGH LIQUIDITY

Daily online transactions

![]()

NO LIMIT ON TRANSACTION SIZE

Unlimited number of times and amount of transaction. No interest-free withdrawal accrued

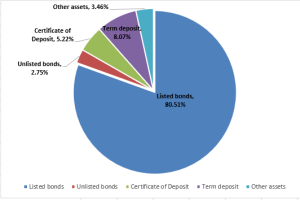

WHAT DOES VNDBF INVEST IN?

VNDBF invests in fixed-income assets

- Listed and ready-to-list bonds: Government bonds and leading corporate bonds with good credit rating and outstanding interest rates

- Certificates of deposit at credit institutions: Attractive interest rates

- Deposits at commercial banks: Competitive interest rates

VNDBF’s asset allocation at Jun 30, 2025

WHO ARE THE CUSTOMERS OF VNDBF?

Corporate bond investment opportunity for individual investors

Currently, only individuals who meet the requirements of being professional investors can invest directly in corporate bonds. VNDBF creates an investment opportunity for non-professional investors to participate in attractive corporate bond market.

A crucial allocation of an investment portfolio

With flexible minimum investment amount only from 100,000 VND, VNDBF is a suitable asset allocation for investors to secure financial well-beings.

Customers who are familiar with bank saving accounts

VNDBF is a perfect substitute for saving accounts thanks to outstanding rate of returns and relative low-risk profile.

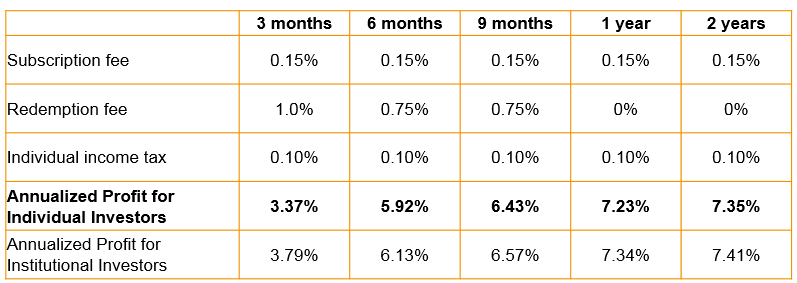

ILLUSTRATION OF VNDBF’S EXPECTED RETURN

VNDBF offers better return than saving account’s and VNDBF’s customers do not bear the risk of losing the term rate of interest if withdrawing early before maturity.

(*Note: Individual investors are subject to income tax of 0.1% of the total redemption value.

Institutional investors are not subject to this income tax.

The optimal term is 6 months or more.

FEES

Effective date: 05/09/2022

Subscription fee

- FREE

Redemption fee

- Less than 3 months: 1%

- From 3 to less than 6 months: 0.35%

- From 6 to less than 9 months: 0.25%

- From 9 months and more: free

FAQs

How long does an open-ended fund operate?

Open-ended fund in terms of duration – no fixed term

What does the fund invest in, what is the stock/bond/cash ratio, is the fund investment risky?

VNDBF profit comes from:

- Bond yields

- Certificates of deposit

- Bank deposits

- Other fixed income assets

The expected return of the bond fund is from 7-8%/year

Where does the fund's profits come from?

The profit of VNDBF is usually higher than bank deposits with the same tenor because the Bond Fund invests in financial assets with higher returns. However, Bond Fund invests in listed bonds that have value based on the demand & supply of the market. Therefore, in the short term, the value of listed bonds may have small changes.

Is the return on an open-ended fund always higher than the saving interest rates?

Open-ended funds aim to achieve long-term returns higher than the interest rates of bank deposits. Bank deposits have guaranteed interest rates so profits are limited. Open-ended funds profit from capital growth and income from investments, so there is no limit to profits. However, in the short term, the fund may have higher or lower returns than bank deposits.

Do open-ended funds guarantee profits? What should I do if the fund is at a loss?

Stock open-ended funds do not guarantee a profit rate (according to the law). The NAV price of fund certificates may fall below the value purchased by investors due to market fluctuations. However, since investing in funds is an investment to get high returns over the long term, the secret to accepting market volatility is to focus on long-term results rather than day-to-day changes.

Liquidity of open-ended funds compared to other investment channels?

The VNDAF open-ended fund has HIGHER liquidity than other investment channels. Fund investors can withdraw part or all of the investment easily and quickly by selling fund certificates to IPAAM at any time. IPAAM is responsible for buying back all fund certificates at the fair price at the time of sale minus selling fees (if any).

How to calculate NAV of open-ended funds?

Fund certificate price = (Total Market Value of Fund’s Assets – Total Debt of Fund)/ Total number of Fund Certificates in circulation.

How transparent is the fund? Is there a risk of losing money?

- All funds and assets of the fund are kept in the fund account in the Depository Bank, BIDV. The equity value is calculated independently and objectively by the Fund Management Department of BIDV.

- Report on the net asset value of the fund and value of fund certificates is published on the trading day on the website of the fund management company: http://ipaam.com.vn; report to the SSC and post it on the SSC website.

- Payment transactions to buy fund certificates of customers are deposited directly into the fund account at BIDV. When the customer sells the certificate, the money from the sale of the certificate is transferred directly from the fund account at BIDV to the bank account that the customer has registered to receive money. Thus, there is no cash transaction from the fund’s account with VNDirect/IPAAM employees, no risks can occur.

Is there a certificate of ownership of fund certificates? If there is no certificate, how to certify the customer's ownership if there is a complaint?

- The value of NAV/Fund Certificate changes constantly, so the investment value of customers also changes weekly, so there is no “Certificate” for the customer because the Fund Certificate can only confirm the amount customer’s fund certificates at a time. The value of NAV/Fund Certificate is constantly changing, so the certificate is not worth much.

- In case of customer request, the Fund Management Company is willing to provide Fund Certificate Account Statement at the time of customer request (such as the Bank providing the Client’s Account Statement).

- All customer transactions: money is transferred to BIDV, matched orders are confirmed by Vietnam Depository Center (VSD), so there is complete evidence of customer transactions confirmed and provided by third parties. Therefore, it is possible to provide sufficient evidence to customers when customers have needs.

Does the fund pay an annual dividend? What is the dividend rate?

Open-ended funds use money to invest, so there is usually no annual dividend policy, but the fund’s profits will be continuously reinvested and profitable for customers. In case the customer wishes to receive the profit of the fund when the price has growth, the customer will sell a part of the fund certificate to realize the profit of the fund certificate. If the fund cannot find effective investment opportunities and change the policy, decide to pay dividends, when the decision is made, we will promptly notify the Customer.

I am also investing in fund certificates of foreign funds, the returns are generally higher, so what's better for me if I invest in domestic funds?

Many foreign investors and foreign funds invest in Vietnam’s stock market, especially in recent years, proving the attraction and potential of the market. You can choose to invest a moderate amount of money in VNDBF fund certificates to diversify the investment portfolio, minimize risks, and have a clear comparison of the investment efficiency between two funds.

How long should I invest in an open-ended fund to get the best return?

According to statistics, open-ended funds provide high returns in the long run, higher than savings interest rates and bond investment rates. Therefore, an open-ended fund can provide a higher return when you invest for the long term. However, the length of time it takes to invest in a fund depends on your own financial goals and the amount of money you intend to invest. We recommend the fund investment period should be 5 years or more.

Does the customer have to keep certain amount of money (or fund certificates) to maintain the account? Is it possible to sell all the fund certificates in the account?

The VNDBF does not require a Minimum Balance to maintain an account. In case the Customer sells all of the fund certificates, the Customer is deemed to close the fund certificate account. When the Customer needs to re-invest in fund certificates, the distribution agent will reactivate the account.

When should I start investing in open-ended funds?

Investment returns from open-ended funds come from the growth of the stock market through the power of compound interest and investment duration. Therefore, you should invest in open-ended funds as soon as possible and as soon as you have determined your financial goals. Delaying investing only increases your burdens and makes achieving your financial goals more difficult.